Housing

&

the CPA

The Data

Despite the statutory requirement that cities and towns spend at least 10 percent of their CPA dollars on affordable housing, it appears that 70 municipalities have spent less than that amount from the time they joined the program through the latest fiscal year. Click the municipalities on the map above to see how each community is spending CPA dollars.

Key Takeaways

Emphasis Has Been Traditionally Placed on Historical Preservation

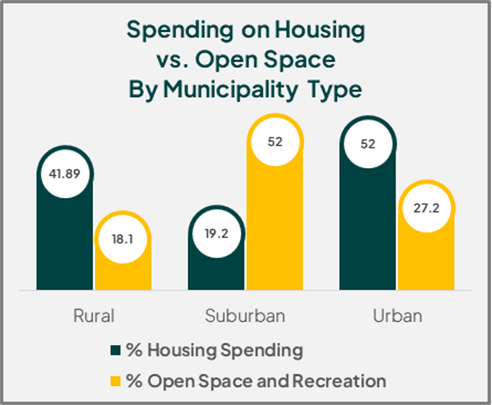

Housing projects have consistently made up less than 20 percent of all CPA activities, whereas historic preservation accounts for over 40 percent and open space and recreation together comprise nearly the same share.

A Path Forward

In the current moment, when housing affordability is a leading policy concern and lawmakers are actively looking to reduce zoning restrictions and accelerate new construction, the CPA is a vital and flexible program which — with the right tweaks — could become a critical tool in the effort to expand housing options for families.

Investments

Offer additional state funds for cities and towns that commit at least 20 percent of their CPA dollars to affordable housing (or 10 percent to support new housing units). Municipalities meeting these higher thresholds could also be given priority access to state grants and subsidies.

01

Accountability

Ensure that all municipalities are meeting the minimum requirement to devote at least 10 percent of CPA revenue to affordable housing. Cities and towns falling below this threshold may need to support additional “make-up” housing projects moving forward.

02

Planning

Encourage cities and towns to better integrate CPA spending with long-term plans around zoning and construction. Subsidized technical assistance from DHCD could be valuable here.

03

Reporting

Require better reporting on housing trusts, including annual spending summaries and concrete project details.

04

Frequently asked questions

What is the Community Preservation Act (CPA)?

Passed in 2000, the Community Preservation Act is a lynchpin of community-oriented policy in Massachusetts. At its core, the CPA is a partnership between municipalities and the state. And this partnership has three basic parts:

1) Cities and towns agree to introduce a surtax on local property;

2) The state provides some matching dollars;

3) The money supports a limited range of activities including preserving historic sites, protecting open space, investing in recreation, and bolstering affordable housing.

Note, however, that there is some friction among these priorities. Efforts to protect open space or expand public parks can impede the development of much-needed housing by reducing the amount of land available for new construction.

How many municipalities are members of the program?

More than 190 cities and towns have joined the program, including regional hubs like Boston and Worcester, gateway cities like Fall River and Pittsfield, wealthy suburbs like Weston and Hingham, and rural hamlets like Leverett and Goshen.

Collectively, these cities and towns have pursued over 15,000 projects representing a total statewide investment of more than $2.7 billion.

Report released in June 2023 by the Greater Boston Real Estate Board in partnership with the Center for State Policy Analysis at Tufts University.

© 2025 The Greater Boston Real Estate Board.